In the latest Hotel Construction Pipeline Trend Reports from Lodging Econometrics (LE), the total Americas—comprising the U.S., Canada and Latin America—hotel construction pipeline stands at 6,399 projects/785,897 rooms.

The U.S. has 5,572 projects/660,061 rooms; Canada has 275 projects/37,359 rooms; and Latin America has 552 projects/88,477 rooms currently in their respective pipelines. Combined, these three regions account for 44% of the projects and 34% of the rooms in the global hotel construction pipeline.

Throughout these three regions, upscale and upper midscale chain scale projects continue to dominate the pipeline, accounting for 4,240 projects/492,591 rooms, or 67% of the projects and 64% of the rooms in the construction pipeline. Certainly, these two chain scales will have the most new hotel openings through 2025.

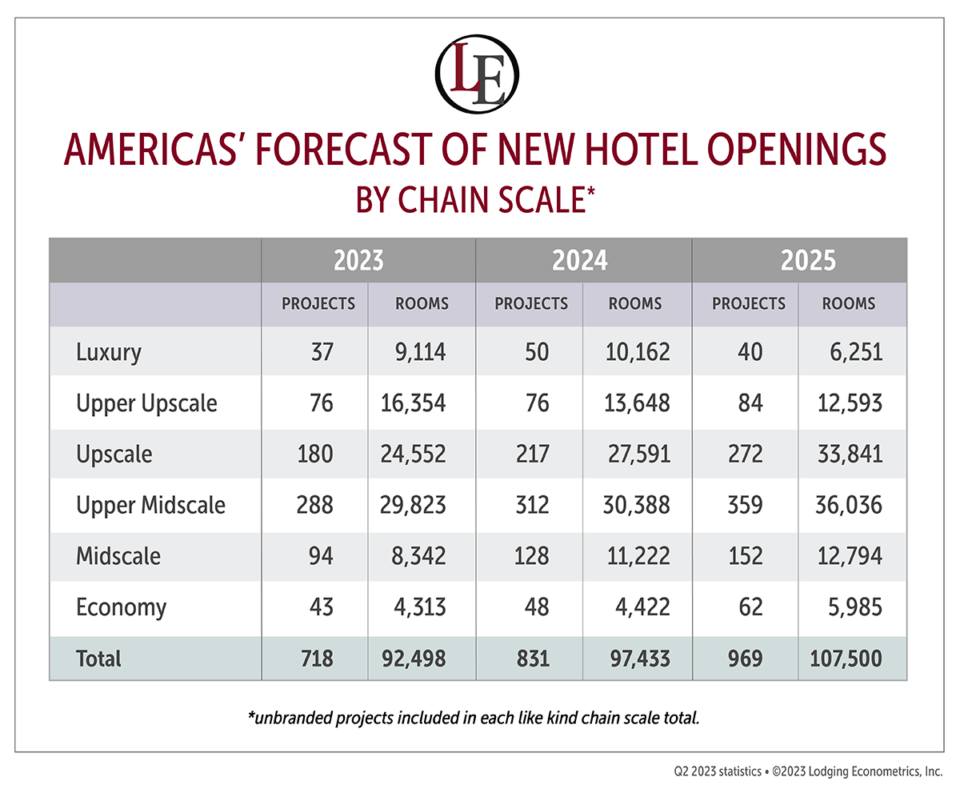

In 2023, LE is forecasting the Americas region to open 718 new hotels having 92,498 rooms. LE is anticipating the U.S. to open 603 projects/73,931 rooms, Canada to open 26 projects/2,870 rooms and Latin America to open 89 projects/15,697 rooms. Most of the new hotel openings in 2023 will occur within the upper-midscale chain scale, where 288 projects/29,823 rooms are scheduled to open, followed by the upscale chain scale, where 180 projects/24,552 rooms are forecast to open.

For 2024, the Americas region will see 831 hotels and 97,433 rooms added to the region’s supply of open and operating hotels. Of this total, 693 hotels with 77,512 rooms are expected to open in the U.S., 33 hotels with 3,951 rooms are expected in Canada and 105 new hotels with 15,970 rooms are forecast for Latin America.

LE’s 2025 forecast for new hotel openings was announced for the first time this quarter and anticipates that 969 projects/107,500 rooms will open in the Americas. Of those 969 projects, 804 with 86,170 rooms will be open in the U.S., 43 projects with 4,537 rooms will open in Canada and 122 projects with 16,793 rooms will open in Latin America.

In both 2024 and 2025, the upper-midscale chain scale will continue to lead openings with 312 projects/30,388 rooms and 359 projects/36,036 rooms, respectively. In these years, the upscale and upper-midscale chain scales will account for 60-65% of the projected openings.

Some of the largest hotel projects by room size scheduled to open in 2023 include the luxury 3,180-room Fontainebleau Las Vegas, and the upper-upscale 1,100-room Senator Riviera Cancun Mexico. In 2024, the upper-upscale 1,200-room VAI Resort in Glendale, AZ, and the 976-room, upper-upscale Signia by Hilton Atlanta Georgia World Congress Center are forecast to open. In 2025, the largest projects by room size forecast to open include the 1,600-room, upper-upscale Marriott International property the Gaylord Pacific Resort & Convention Center in Chula Vista, CA, and the unbranded, upper-upscale 1,035-room Convention Center Hotel in San Diego, CA.

For more information on individual hotel development projects, their projected open dates, and project decision-makers in the Americas or any other region, country, or city worldwide, contact Lodging Econometrics at [email protected] or 603.431.8740, ext. 0025.