Blurred Lines: Redefining Traditional Distribution Systems Definitions

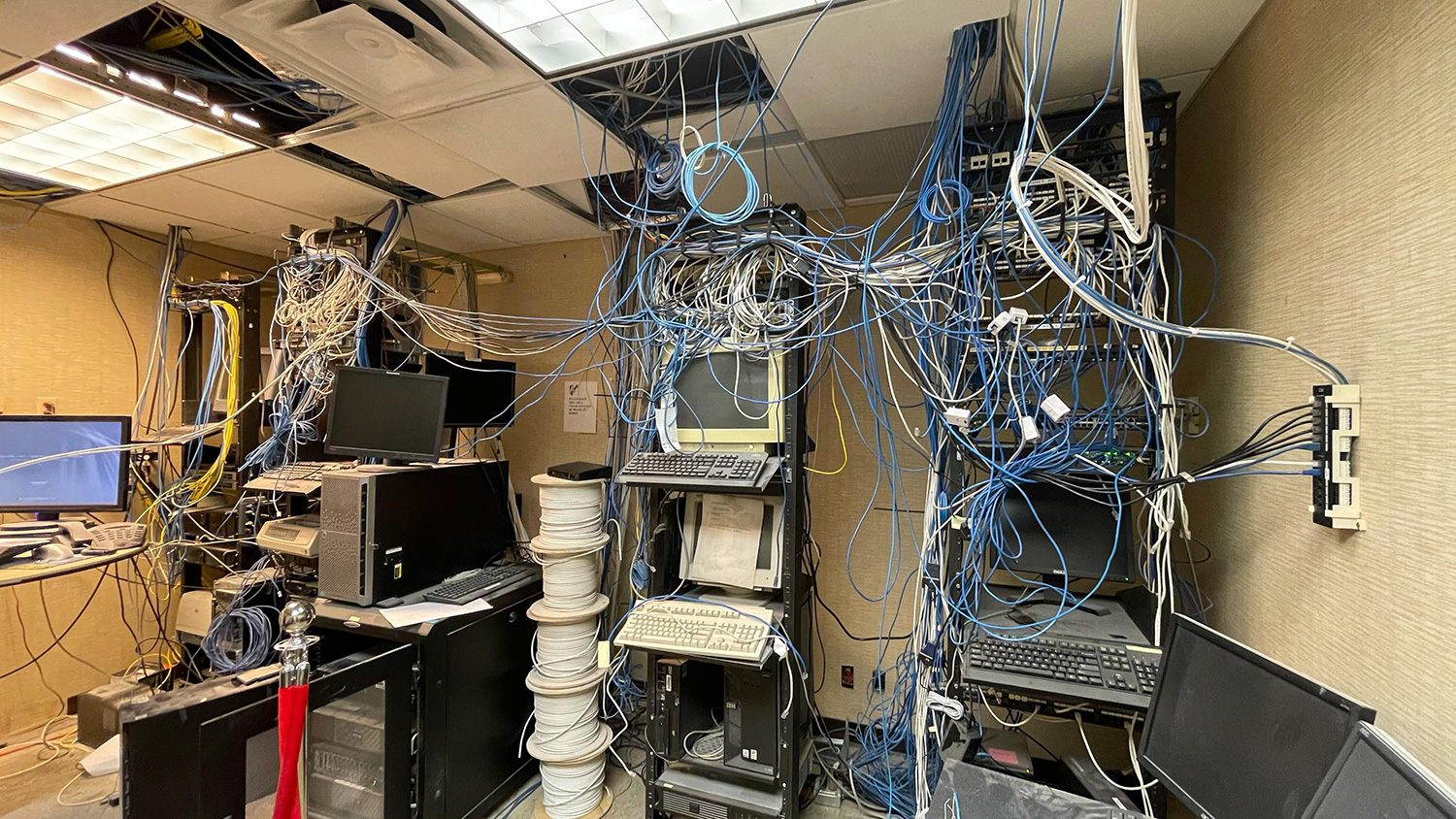

Hotels use, on average, 20 discrete on or above-property systems to service their guests, manage operations, and facilitate commerce. This complicated web of systems was born out of necessity, because of the complexity of running a hotel. As a result, data has become siloed, which in turn has led to new commercial and operational challenges. If we look at distribution specifically, those disparate systems are not just challenging to manage, they also result in significant revenue being left on the table. But due to recent technology advances, hoteliers can be more forward-thinking with their approach and build their technology stack in the right way.

In this article, we will look at the causes of fragmentation in distribution, and how the problems of yesterday have created the roadmap to a streamlined tomorrow.

According to a 2023 Duetto Hotel Benchmarking Report, 83% of hoteliers struggle to manage their data due to fragmentation, and 76% say that this impacts their ability to make sound business decisions. McKinsey & Company estimates data fragmentation costs businesses an estimated $1.1 trillion annually. Hotels and their guests deserve better.

Definitions of Distribution Systems

To understand where we are going, we must first know where we came from and the current reality of the hotel distribution stack:

-

PMS: The Property Management System traces its roots back to the 1970s when hotels first started computerizing guest records and in-house operations. Sitting at the center of the hotel's technical architecture, the PMS manages daily operations, including guest check-in/check-out, room rates, availability, inventory, guest billing, and more. With the push for more cloud-based PMS systems in recent years, opportunities for increased connectivity have greatly expanded.

PMS: The Property Management System traces its roots back to the 1970s when hotels first started computerizing guest records and in-house operations. Sitting at the center of the hotel's technical architecture, the PMS manages daily operations, including guest check-in/check-out, room rates, availability, inventory, guest billing, and more. With the push for more cloud-based PMS systems in recent years, opportunities for increased connectivity have greatly expanded. - CRS: The Central Reservation System sells (primarily) room inventory and emerged in the 1970s as a complement to the PMS. Its evolution was catalyzed by the growth of global distribution systems (GDS) in the 1980s and, in the 1990/00s, became more sophisticated to support the growing number of distribution channels, both direct (app and website) and indirect (OTAs (Online Travel Agencies) and wholesalers). Today, most CRSs offer a Booking Engine, offer management, and Channel Management.

- CM: A Channel Management system provides the “pipes” connecting room inventory to demand. This innovation dates back to The Hotel Industry Switch Company (THISCO) in the late 1980s, connecting 16 of the largest chains with the seven GDSs. As distribution evolved and the popularity of online booking channels surged in the 2000s (specifically from Online Travel Agencies, like Booking and Expedia), a new breed of technology providers enabled the connection of demand into hundreds of distribution channels.

- BE: Booking Engines are guest-facing shopping carts for hotels to sell their inventory directly to guests. The first hotel online booking engine was launched in 1996 by Hotel Reservations Network (HRN). In a 2022 survey by the Hotel Technology Next Generation (HTNG), over 95% of hotels use a website booking engine to facilitate direct reservations. A booking engine is often offered bundled with a PMS or CRS. Chains and independent technology providers have developed BEs to match guest and hotel needs.

Why Fragmentation Creates Distribution Issues

The systems of old suffered from several problems that are endemic to a fragmented architecture: redundant inventory models, increased operational complexity, ineffective guest profiling, service concerns, limited cross-selling, and increased distribution costs.

An on-premises PMS server doesn’t have the technical capabilities to support effective room shopping, but reservation data is still needed to facilitate operations. As a result, the CRS became the de facto distribution source of availability, rates, and inventory (A.R.I.) to sell rooms. Having two different sources of inventory , combined with antiquated technology connections, can create parity issues, even with a two-way sync. When inventory gets out of parity, a manual effort by the property's night auditor or distribution team is needed to reconcile A.R.I.

An on-premises PMS server doesn’t have the technical capabilities to support effective room shopping, but reservation data is still needed to facilitate operations. As a result, the CRS became the de facto distribution source of availability, rates, and inventory (A.R.I.) to sell rooms. Having two different sources of inventory , combined with antiquated technology connections, can create parity issues, even with a two-way sync. When inventory gets out of parity, a manual effort by the property's night auditor or distribution team is needed to reconcile A.R.I.

Servicing multiple sources of A.R.I. is quite taxing for hotels. Distribution and revenue managers need to maintain offer information across the PMS and CRS. If an issue arises, the PMS and CRS providers will often point the finger at each other.

Beyond operational issues, this fragmentation also hinders a hotel's understanding of a guest and their ability to cross-sell inventory. For a full-service property, a guest's value is captured within multiple points of sale, and part of the lifetime value is unknown because data is siloed and not aggregated into their Guest Data Platform.

Hotels often incur unnecessary distribution costs by maintaining a redundant architecture compared to a modern framework. Licensing multiple systems with overlapping features increases costs and decreases owner profitability.

A Hospitality Sales Platform

According to a Hotel Technology Study by Hospitality Technology magazine, the PMS accounts for 26% of the total hotel software budget and the CRS another 12%; the CRS cost is likely higher due to transactional costs on top of software costs.

Today, multiple systems are required to sell rooms to guests and few hotels can cross-sell inventory across multiple points of sale. A shift to cloud components has begun reshaping the boundaries by delineating systems and creating new opportunities. Modern cloud architecture can enable an interconnected and agile platform improving profit and guest experience all while using fewer systems. For example, the new breed of Cloud PMS systems unlock new connectivity and reduce the need for more systems through direct connections to OTAs and other important demand channels for hotels. Cloud PMS architecture make it easy to scale up quickly, whether you have a handful of hotels or thousands, something that On Premise PMS systems couldn’t enable.

A 2017 Cornell Hospitality Report indicated that while 85% of large hotel chains invested in integrated systems, and only 40% of independent hotels did the same, primarily due to cost concerns. It’s time to re-think the roadblocks of the past; it is no longer necessary to manually manage multiple systems because there was a person to do it. Unified platforms that are now available have enabled the shift to a single source of A.R.I.. As a result, hotels can eliminate superfluous systems without impacting distribution by directly connecting a Booking Engine (for direct distribution), GDS, various demand partners and a Channel Manager (for indirect distribution) to the source of ARI truth, the PMS. This is only valid for cloud PMS solutions that have been extended to complete Hospitality technology platforms, including smart cache capabilities for distribution needs.

Guests today expect a one-stop-shop for any experience, and shopping for a hotel is no different. Hotels want to use their Booking Engine to sell all inventory on-premises (room, spa, golf/ski, retail, event space, activities, etc.) or around property (curated local food and experiences). The dream of many hoteliers is a single shopping cart booking engine connects to the operational systems that best support each line of business. Presented as a digital concierge, hotels get to know their guest better, increase their value, reduce transaction costs, improve conversion, reduce OTA dependency, and improve their guest experience. Hotels should prioritize selecting technology vendors who support open APIs for communicating inventory availability and pricing, as they can easily slot into today’s new cloud first technology providers.

Last year hoteliers invested less than 2.75% of room revenue (STR) in technology - compare this to 15%-20% for the OTAs.

- Max Starkov, NYU professor. Until hotels take their technology investment more seriously, OTAs will continue to target guests for their room, dining, and activity reservations (Booking owns OpenTable, Fareharbor, Kayak, etc). A share shift away from their 12-30% commission justifies the investment in the direct channel.

Given the technology advancements we have seen over the last few years, hotels are finally close to being able to streamline their distribution technology stack to reduce cost and complexity, both for room and non-room inventory. Perhaps the rigid acronyms of old no longer fit; the PMS could be recast as a Hospitality Platform at the core to the operational and commerce model, The hotels that are able to operationalize these capabilities will have a competitive advantage, and stand to drive incrementally more net operating income to their hotel investments.

Technology is constantly evolving – creating new opportunities in all areas of a hotel. The latest and greatest tech is now available and it’s now up to the hotel industry to take the next step. The options seem endless – what that means though is the “next step” does not have to be the same for each hotel, it just needs to be taken.