Inflation, supply-chain delays and the labor crisis were all concerns throughout this year, as hoteliers stayed on the path of recovery. But will these issues continue into 2023? During the latest Hotel Business Hot Topics session, “The Time Is Now: Prepare Your Business for 2023,” in partnership with Entegra, industry leaders discussed the trends that will carry over into next year and how hoteliers can get themselves ready for anything thrown at them in the year to come.

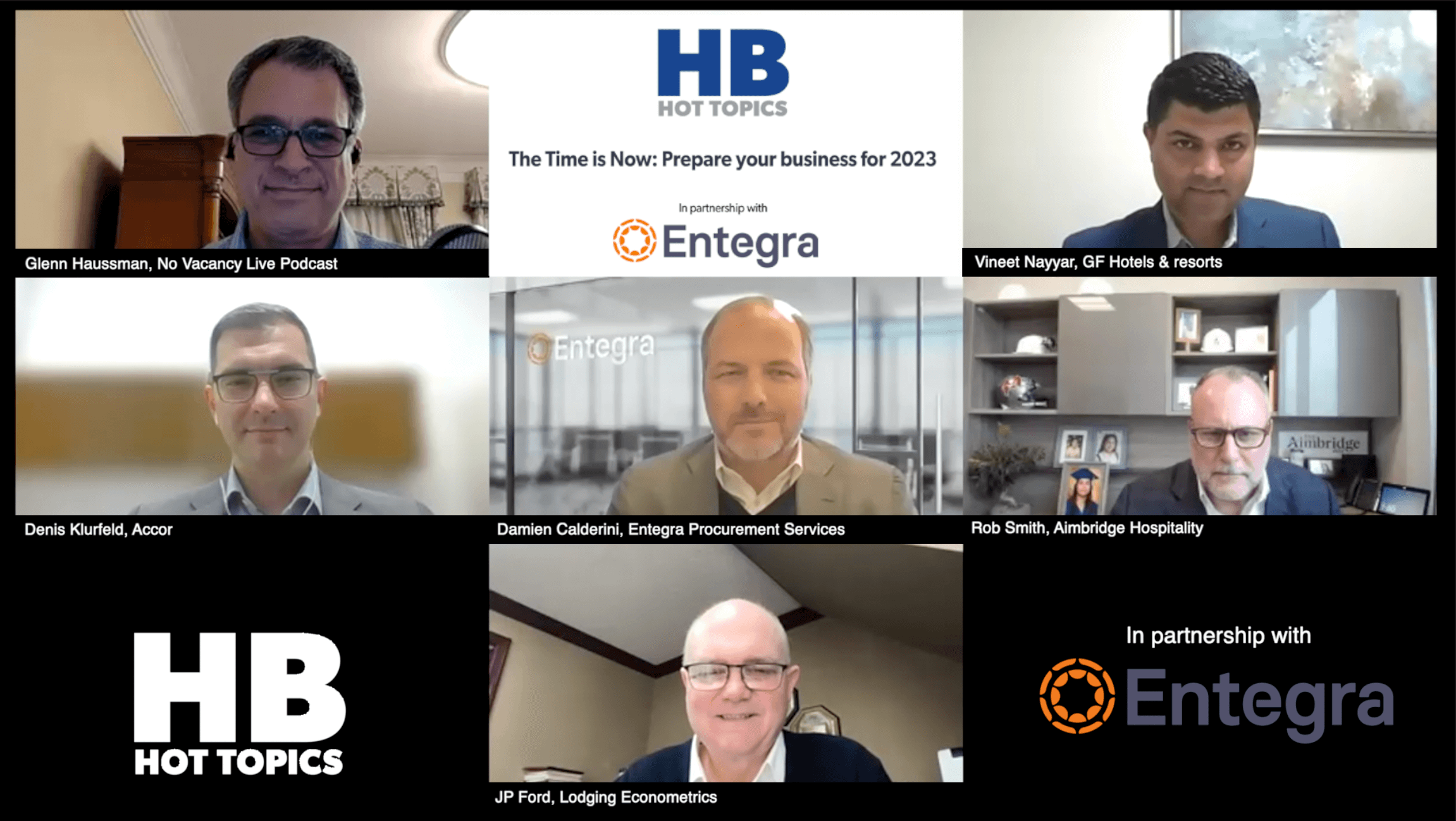

Moderator Glenn Haussman, founder/host, No Vacancy Live podcast, was joined by panelists Damien Calderini, president/CEO, Entegra; JP Ford, SVP/director, global business development, Lodging Econometrics; Denis Klurfeld, VP, procurement, North & Central America, Accor; Vineet Nayyar, president/COO, owned division, GF Hotels & Resorts; and Rob Smith, divisional president, full-service, Aimbridge Hospitality.

Hausmann first asked the panelists what they thought the biggest issue will be in 2023. Before providing his answer to that question, Calderini brought up the topic that is likely on every hotelier’s mind at the moment—inflation.

“No one can predict the future, but we really believe that inflation is here to stay,” he said. “Inflation is global and it’s driven by factors that will not go away overnight. People were wondering whether the election might have an impact on it one way or the other. I will tell you that we don’t believe that will be the case.”

He added that the causes of inflation are “the war in Ukraine, which everybody understands the impacts that it has on the grains that are not being transported; labor issues, whether it’s just simply not finding truck drivers to be able to move the goods, or it is back or front of the house [on the property level].”

However, inflation is not the most concerning issue in Calderini’s eyes; instead, it’s the weather and avian flu.

“The biggest impact to the supply chain challenges and the food challenges we’re seeing today is the weather,” he noted. “Quite frankly, we should all look at how the weather is going to be in early 2023 and hope that we get the weather that we need because that is going to be the main driver. The second one is avian flu. Every year you see avian flu spiking once, but what are we seeing this year? It’s coming, it’s going, but it’s coming back and it keeps coming back. That’s going to have significant damage.”

Nayyar believes the biggest thing the industry is dealing with is the uncertainty of what will happen in the future. It’s certainly something that hasn’t left since the pandemic began.

He offered a way to deal with the uncertainty. “We can control ourselves by being proactive [and] efficient,” he said. “Two years ago, we were talking about isolation; now we’re talking about inflation. Margins are going to be tough… You’re paying more and you’re getting less.”

Smith pointed out that there is so much uncertainty going forward that you can’t plan for just one outcome.

“All these factors that have been noted are all variables,” he said. “They’re all things that are sitting out there that have the potential to take what we see today and wreak havoc tomorrow. A lot of things that we’re doing now as we build budgets, we’re building them for the things that we know we can affect—the things we see today. And we’re building four or five contingency plans behind those so that as things do change, we’re able to react quickly and nimbly.”

Hoteliers will also have to deal with travelers whose priorities have changed as to what they expect from a hotel stay. Haussman asked Klurfeld if he is seeing the products that are going into the properties reflecting the demands of today’s guests.

“We had to rethink everything from the ground up in terms of what people care about, what they expect and what they no longer want,” said the Accor executive. “And that really focuses the procurement on what really drives value, all of the non-value-added products and services, you either eliminate, automate or outsource. So, we essentially have been really focusing the procurement efforts on identifying what really is going to drive value in the next two to three years and really focusing on those aspects of the guest experience.”

Going back to the issue of inflation, the moderator asked Ford, whose company monitors hotel construction globally, how the increase in interest rates is affecting the pipeline.

“It’s really causing developers to pause, sit back [and have a] wait-and-see attitude,” said Ford. “There are about 985 hotels under construction in the United States right now. Prior to COVID, we were well into a thousand under construction. We have [more than] 4,000 hotels that are either going to start in the next 12 months or are in the early planning [stage]. Supply chain issues are also a problem. You can’t find the products that you need as fast as you need them. So, with interest rate increases and supply chain issues, the movement of projects through the pipeline isn’t going as fast as what it did pre-COVID.”

Look for more coverage of this Hot Topics session in the Hotel Business Green Book.