In the world of real estate, hotel acquisitions stand apart, blending the intricacies of property deals with the dynamics of the hospitality industry. Here, we shine a light on the specialized factors that differentiate hotel acquisitions.

In the world of real estate, hotel acquisitions stand apart, blending the intricacies of property deals with the dynamics of the hospitality industry. Here, we shine a light on the specialized factors that differentiate hotel acquisitions.

The importance of location and micro-location

Every real estate professional knows the value of location, but in the hotel industry, it’s not just about city or region. The micro-location, such as proximity to tourist attractions, business districts, or transportation hubs, can drastically influence occupancy rates and revenue potential. In a research study on hotel values within the Chicago Metropolitan Statistical Area conducted by Maxence Valentin and John W. O’Neil, the study’s authors state that hoteliers and hotel investors should be aware of the significant difference in value carried by properties located relatively closer to the city center. On average, the study found that an incremental mile away from the city center decreases hotel market value by 13.0% for the first 10 miles. This effect should be taken into account by professionals when valuing hotel properties10.

Comprehensive RevPAR analysis

Revenue per Available Room (RevPAR) is a critical metric in the hotel sector. A holistic analysis of RevPAR, accounting for seasonal variations and compared against competitors in the same segment, offers insights into a property’s revenue-generating capability. PWC expects 2024 RevPAR to increase by 2.7% over 2023, which equates to approximately a 117% increase over pre-pandemic levels, with almost all of the increase coming from an increase in Average Daily Rate (ADR), which has the biggest impact on hotel profitbailty3. Analyzing RevPAR regularly and against competitors provides invaluable revenue potential insights.

Delving into the STR Report

The STR report, a mainstay in the hotel industry, provides benchmarking data regarding occupancy, average daily rates, and RevPAR. STR data reveals that in 2019, U.S. hotels had an average occupancy rate of around 66% and ending 2023 near 63%1&2, almost reaching pre-pandemic levels. Utilizing this data helps potential buyers understand their position in the market landscape.

Brand affiliation and its implications

A hotel’s brand affiliation can significantly impact its valuation. From international luxury chains to boutique brands, understanding the advantages, constraints, and royalty structures associated with each is crucial. While over the past several years independent and soft branded hotels have grown RevPAR at levels higher than franchised and affiliated hotels, a study conducted out of the Pennsylvania State University and Orebro University by John W. O’Neil and Mats Carlback, respectively, shows that franchised and affiliated hotels were able to flow more profit to the Net Operating Income line than the independent and soft branded hotels in their study, highlighting that franchised hotels, despite brand fees, are able to retain their RevPAR resulting in higher profit margins4&5. Grasping the nuances of affiliations – benefits, limitations, and royalties – is thus essential.

Capital expenditure (CapEx) projections

Hotels, unlike other real estate assets, require continuous investments to remain competitive. A clear understanding of future CapEx needs, from room renovations to technology upgrades, is essential for accurate financial forecasting. A CapEx study from the International Society of Hospitality Consultants (ISHC) states that hotels spend an average of 7% of their annual revenues on CapEx, which is higher than the typical 4% FF&E reserve underwritten industry wide6. Recognizing forthcoming expenses, from refurbishments to tech enhancements, is foundational for financial projection accuracy.

Management agreements and operational contracts

Delving into existing management contracts, franchise agreements, and vendor contracts is crucial. These agreements can influence operational flexibility, financial obligations, and even the exit strategy.

Guest experience and online reputation

In the age of digital reviews, guest satisfaction scores on platforms like TripAdvisor or Booking.com can provide insights into operational quality, service standards, and potential areas of improvement, as well as have a direct impact on the hotel’s financial performance. A study with insight provided by ReviewPro showed that a 1% increase in a hotel’s online reputation score leads to an approximate 0.89% uplift in price (ADR) and a 0.54% growth in occupancy, emphasizing the link between reviews and financial success7.

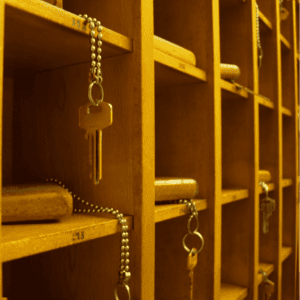

Due diligence on licenses and permits

Hotels operate within a web of regulations. Ensuring that all operational licenses, from liquor to entertainment, are in place and compliant is a non-negotiable aspect of the acquisition process.

Feasibility of renovating, repositioning or rebranding

Every acquisition carries the potential for value addition. Evaluating the feasibility and financial implications of renovating, repositioning or rebranding can uncover hidden value propositions. JLL reported that effectively renovated hotels have experienced a 13.5% increase in room revenues post-renovation8.

Employee contracts and union agreements

Hotels often employ a sizable workforce, and understanding the nuances of employee contracts, union agreements, and staff benefits can have substantial implications on operational costs and flexibility. Understanding these nuances is pivotal. In 2022, the Bureau of Labor Statistics noted that unionized employees earned about 18% more than their non-union counterparts, influencing budget considerations9.

Navigating the complex world of hotel acquisitions requires not just a keen business acumen but also a deep understanding of the unique facets of the hospitality industry. By focusing on these industry-specific elements, potential buyers can ensure a strategic, informed, and value-driven acquisition process.