Less spending on labor has been a big reason why U.S. hotel profit margins have held strong, but that spend is on the rise with labor costs growing at a compound monthly rate of 3.7 percent in 2022.

Gross operating profit (GOP) came in at 42.3 percent in 2022, which was 0.6 percentage points higher than 2019. That success in maintaining profit levels can be largely attributed to more efficient operations (i.e., less frequent housekeeping, limited F&B offerings, adjusted hours) in addition to the lower labor spend. While efficiencies like less housekeeping may have a longer shelf life, labor costs continue to rise with higher wages due to inflation, more hours worked by current staff, and more wages paid out to contract workers. Many hospitality companies are already paying workers well beyond minimum wage in order to attract and retain workers—the average hourly wage of all employees in the leisure and hospitality field is $20.10 per hour, according to the Bureau of Labor Statistics. While hoteliers have been able to pay at that level and maintain efficiencies through maximizing employee hours and paying out less benefits by using contract labor, this is not a viable long-term strategy as it can impact brand standards.

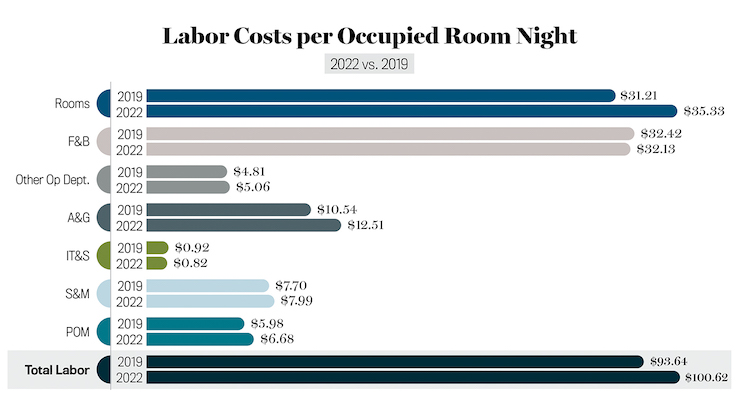

The unemployment rate in the hospitality industry has remained one of the highest—5.4 percent in December—and that rate is unlikely to improve with an anticipated recession. Thus, higher labor costs will remain the norm. In 2022, labor per occupied room (LPOR) was $7 higher than in 2019, and when drilling down to the department level, we see that most of that increase came via the rooms department. LPOR for the rooms department was $4 higher than 2019, which represented an increase of 13.2 percent. All departments, except for food & beverage (F&B) and information technology & services (IT&S), realized growth in labor costs versus 2019, with administrative & general (A&G) realizing the largest percent change at +19 percent. For the F&B department, group business and corporate travel are still lagging, so F&B revenues (and expenses) have not reached 2019 levels. Being so labor-intensive, F&B is a costly department for hotels. F&B expenses account for 70 percent to 75 percent of F&B revenues, and labor is 50 percent of that average. As hotels look to regain lost group business, balancing the need for labor with F&B expenses will be even more challenging.

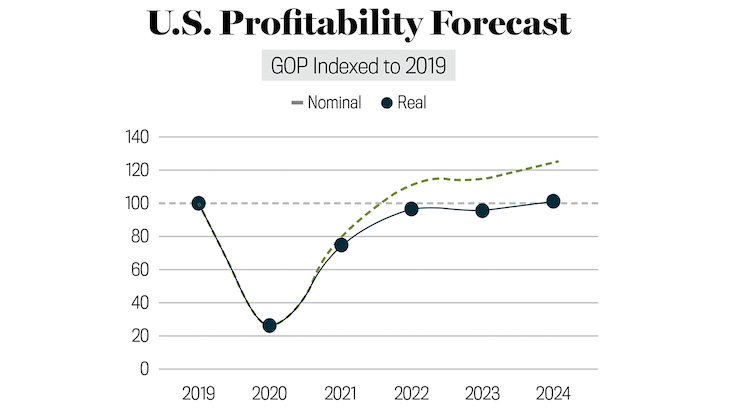

Based off recent data trends and an analysis of STR’s profitability data going back to 1990, STR just this year began forecasting profitability. After increasing 38 percent in 2022, GOPPAR is expected to increase just 2.5 percent in 2023 and 6.6 percent in 2024. The slower growth projection can be attributed to costs growing at a level higher than ADR. That means expenses are going to erode profits as inflation and labor costs grow faster than RevPAR. So, while GOPPAR will continue increasing, the rate of growth will be slower than that of RevPAR.