In the ever-evolving hospitality industry, the question of how to effectively compensate hotel operators remains crucial. While the basic premise of paying managers for their management skills holds true, the prevalent incentive fee structures may no longer adequately align with market realities, particularly for owners.

NB: This is an article from HVS

Subscribe to our weekly newsletter and stay up to date

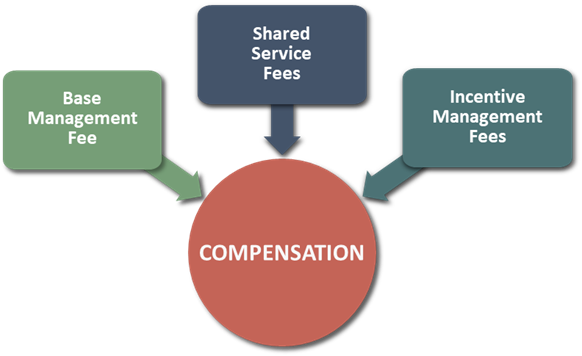

Management Fees Breakdown

Hotel management companies earn fees through three main avenues:

In the typical hotel management agreement, hotel management companies are typically paid a base fee equal to 2.0% to 4.0% of total operating revenue—3.0% being the most common—plus an incentive, typically an incentive management fee (IMF). The base management fee typically covers the services provided by the management company for the day-to-day operation of the hotel, including overall management oversight, staffing, training, budgeting, financial reporting, and operational support. This fee is intended to compensate the management company for its expertise, time, and resources expended in managing the property and ensuring its operational success, although it does not directly tie the management company’s earnings to the hotel’s profitability like an incentive management fee does.

Shared services fees in hotel management agreements refer to charges levied on a hotel for the centralized services provided by the hotel’s management company or parent brand, such as marketing, reservations systems, and technology support. These fees allow for economies of scale by spreading the costs of these services across multiple properties within the management company’s portfolio, potentially leading to enhanced operational efficiency and improved profitability for individual hotels by reducing their direct costs for such services. Shared services fees typically differ from operator to operator given the variability of corporate employee salaries and the portfolio size of each management company. Shared services fees are often standardized across a hotel operator’s or brand’s portfolio, reflecting the costs of centralized services that benefit all properties. This standardization means there is little room for customization or concessions on a per-property basis, as operators are keen to maintain consistency and fairness among all their managed hotels.

Incentive management fees are a compensation mechanism designed to align the interests of the hotel manager with those of property owners. These fees are typically structured on top of a base management fee and are calculated based on the hotel’s financial performance exceeding certain predefined thresholds. Incentive fee structures vary, but over the last decade or so, they have coalesced around a formula that pays managers between 10% and 20% of cash flows that exceed a certain performance threshold. This threshold is generally reached when the adjusted gross operating profit (AGOP) exceeds a return on the owner’s investment (often the development cost associated with the project) of between 8% and 12%. AGOP is typically defined as the gross operating profit (GOP) less the following exclusions:

The idea behind the IMF is to incentivize operators to surpass financial benchmarks for the GOP and thereby earn additional fees, which theoretically encourages them to operate the hotel more efficiently and effectively, leading to mutual benefits for both the management company and the hotel owner. However, increasingly, owners are experiencing financial pressures from all angles due to the rising costs of goods, labor, insurance, utilities, and everything in between, prompting a rethink of all expenses, including management fees.

Incentivizing managers based on the AGOP is meant to align the interests of management companies with those of owners. This practice, however, does not adequately compensate for an important facet of management—the manager’s performance. The current structure of incentive fee thresholds is affected too much by the general performance of the market, rather than operating results achieved by management exclusive of market performance.

As a case in point, when the lodging market was in the doldrums due to the impacts of the COVID-19 pandemic in 2020 and 2021, management companies struggled to earn the incentive management fee; however, when the lodging market recovered in 2022 and 2023, management companies began earning record-breaking incentive management fees, lifted by strong topline revenues across the board as travelers engaged heavily in “revenge travel.” Notably, Marriott International, the world’s largest hotel operator, announced that in calendar-year 2023, it earned 20% more incentive management fees than in 2019, its prior peak.[1] Similarly, Hyatt Hotel Corporation announced that in Q3 2023, 23% more Hyatt-managed hotels activated the incentive management fee clause than in the same quarter in 2019, prior to the onset of the COVID-19 pandemic.[2]

A better incentive management fee system would compensate high-performing managers for better-than-average performance in both good and bad years based on a variety of metrics, not just a percentage of AGOP. This incentive methodology would be similar to the bonus structure of a hotel general manager.

An Alternative Incentive Fee Structure

Conceptually, a management company’s effectiveness is evidenced by two main results: the ability to generate an appropriate share of top-line revenue within the relevant competitive market (maximizing RevPAR penetration[3]) and the ability to convert that revenue into as much sustainable cash flow available to the owner (GOP) as possible. Thus, a more comprehensive way to calculate the incentive management fee payout would include considerations of the following five factors: