The Hospitality Industry Sentiment (HIS) survey is STR’s quarterly study capturing the experiences and expectations of travel industry professionals. This survey began in Q4 2022, and with the fifth edition completed in Q1 2024, some trends have solidified while others appear to be reversing course.

NB: This is an article from STR

Subscribe to our weekly newsletter and stay up to date

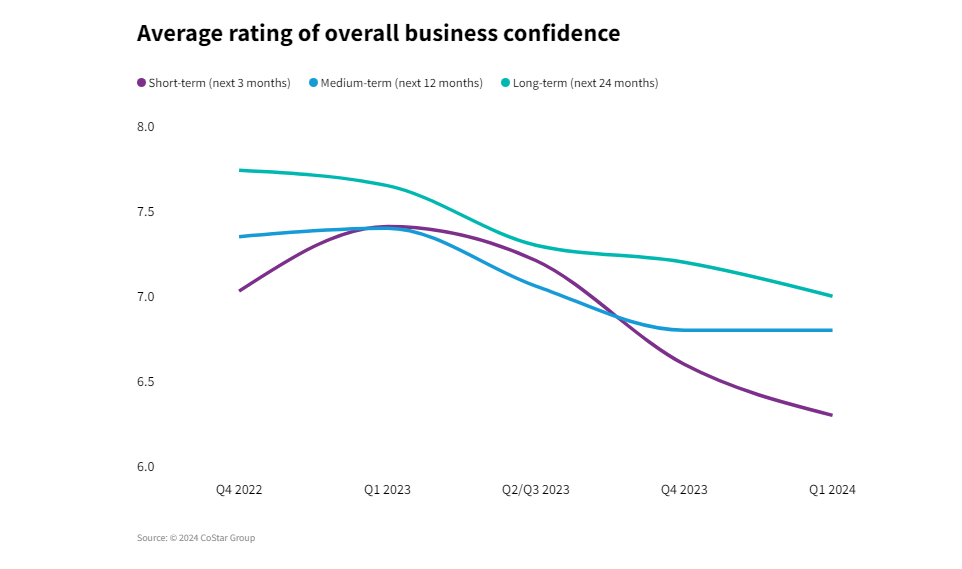

Each quarter, we ask our global community of travel industry professionals to rate their overall business confidence over the next three months (short-term), the next year (medium-term) and the next two years (long-term). Compared to the previous iteration of this study in Q4 2023, overall business confidence for the next 12 months has held steady, with 35% of respondents rating their confidence at an “8” or higher on a 10-point scale.

On average, however, business confidence ratings in the short- and long-term continue to trend downward. Long-term ratings remain the most optimistic, with 46% of respondents rating their confidence as “8” or higher in the most recent survey — but long-term confidence has also seen the largest and steadiest decline since this study began.

Average rating of overall business confidence

Using only the average ratings from a 10-point scale can hide certain trends, so it’s worthwhile to look at the results from each end of the rating scale as well. In this case, the trend of optimistic ratings (“8” or higher) closely mirrors the results of the average ratings shown above. Meanwhile the less-optimistic ratings (which we define as “4” or lower on the 10-point scale) have shown a concerning trend of growth, particularly in the short-term ratings, where 20% of respondents have indicated their wavering confidence.

Percent of low ratings (“4” or less out of 10)

Expectations for different demand segments are also mixed. Predictions for business transient demand and group demand growth have trended steadily downward since this question was added to the survey a year ago. In each of those segments, however, expectations remain relatively optimistic; nearly 60% of hotel respondents expect growth in the business transient sector of travel, with closer to two-thirds indicating optimism for group demand growth.

On the other hand, expectations for leisure transient growth are lower. But in the most recent survey, hotel expectations have bounced back to a (very slight) majority of respondents with a positive outlook for growth: